How To Get Ein For Llc In California

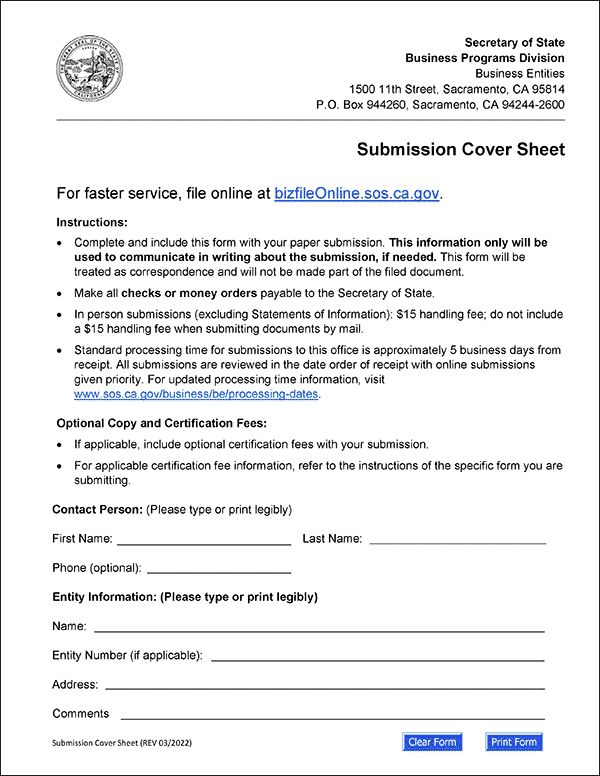

To register you must file form llc 5 application to register a foreign limited liability company and pay a 70 fee.

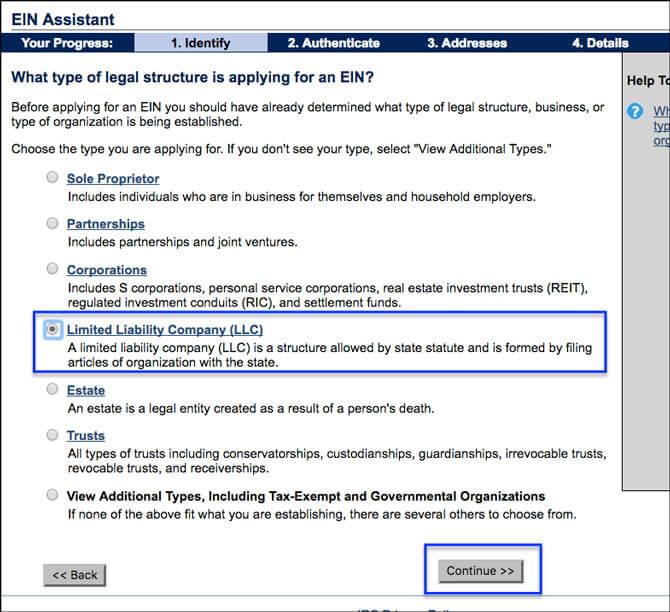

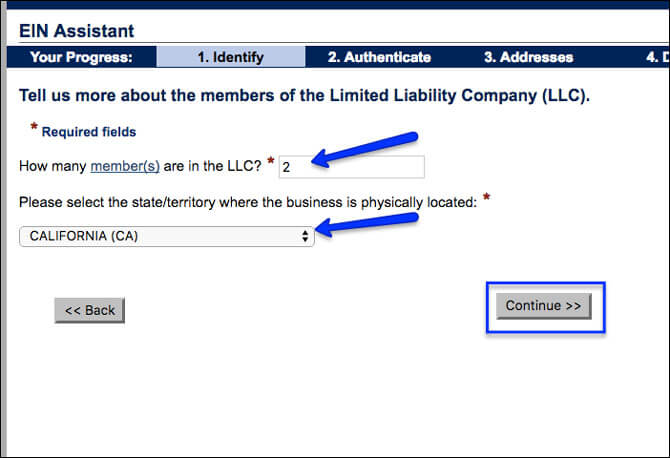

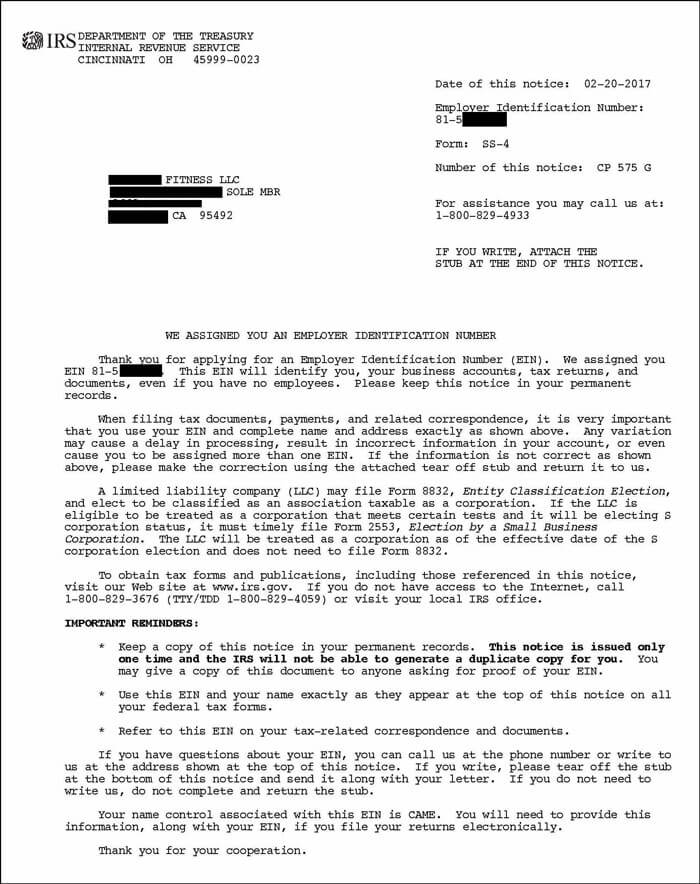

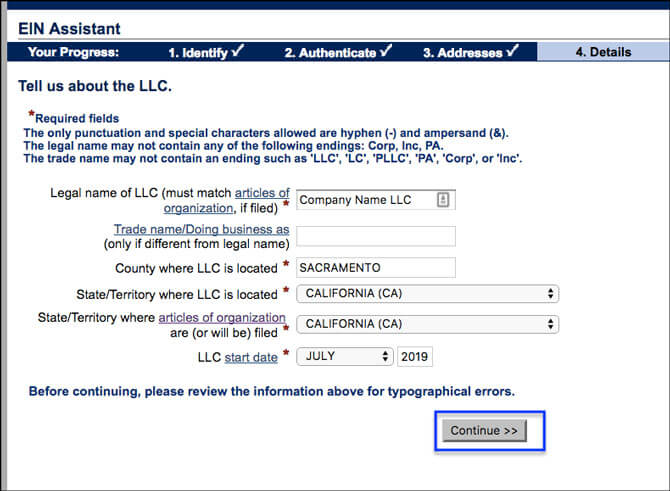

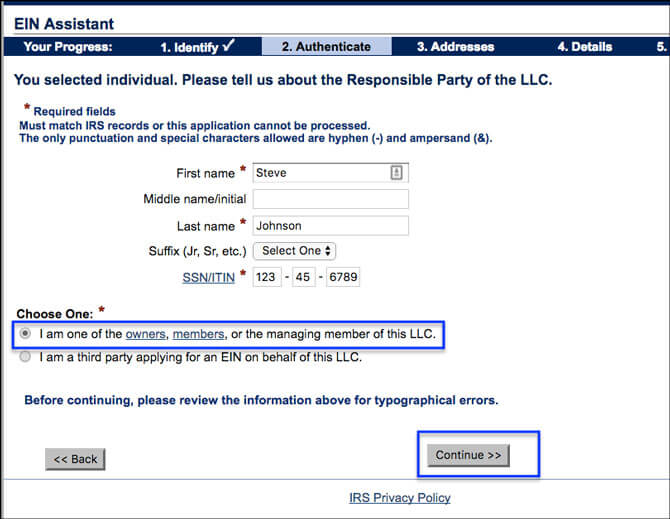

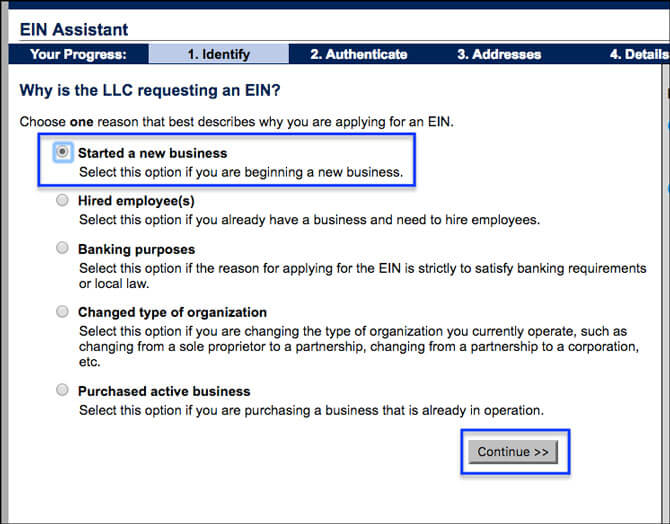

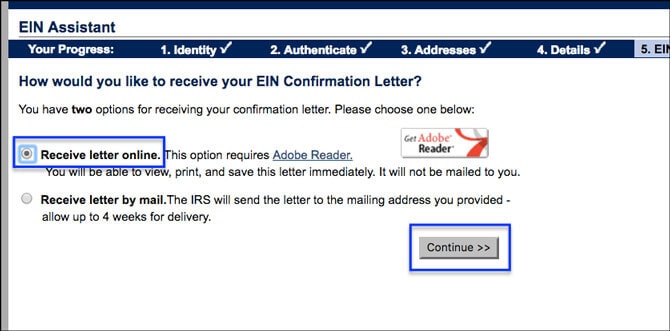

How to get ein for llc in california. At some point during the process of setting up your business you obtained an ein. The person applying online must have a valid taxpayer identification number ssn itin ein. Apply for california tax id ein number apply for a california tax id ein number online to begin your application select the type of organization or entity you are attempting to obtain a tax id ein number in california for. Be sure to choose a name that.

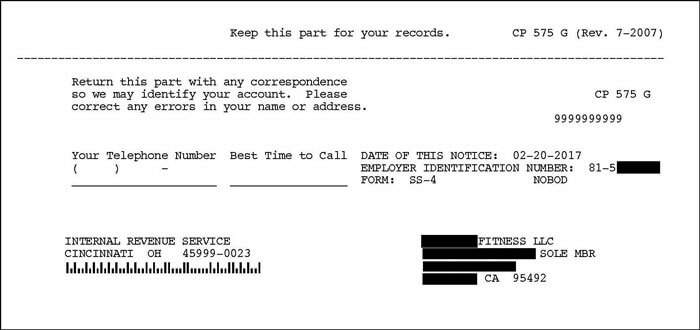

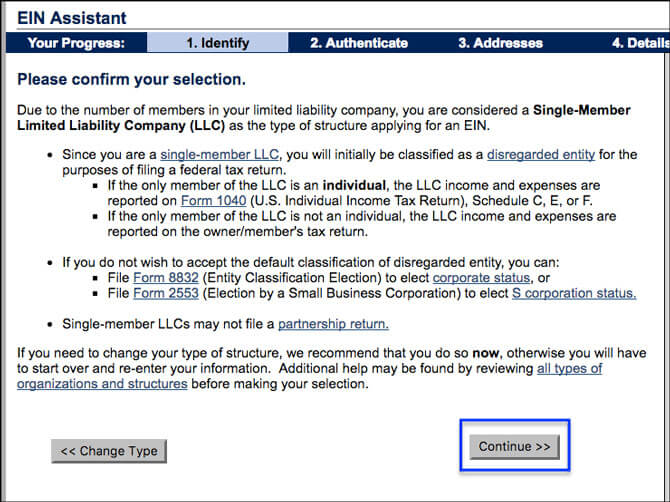

You are limited to one ein per responsible partyper day. Having an ein for your california llc enables you to do the following. All llcs organized outside of california must register with the california secretary of state to do business in california. File the california.

Starting an llc in california is easy just follow these simple steps. Choosing a company name is the first and most important step in starting your llc. You may apply for an ein online if your principal business is located in the united states or u s. Open an llc business bank account file taxes at the federal state and local level handle employee payroll if applicable obtain business lines of credit or business loans get a business credit card for your llc apply for.

Choose a registered agent in california. Name your california llc. The form must be filed by postal mail or may be dropped off in person for an additional fee.