How To Get My Credit Score Up

Lower your credit.

How to get my credit score up. Paying your bills on time is one way to show lenders that you re responsible with credit. Do these two things and then toss in one or more of the sneaky ways above to give your score a kickstart. Scan your cards and get a line of credit as well as manage payments. Pay your bills on time.

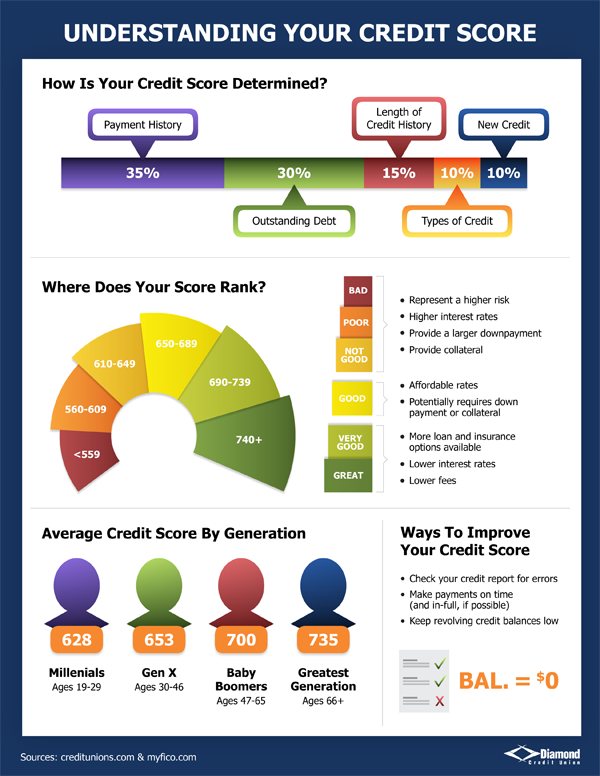

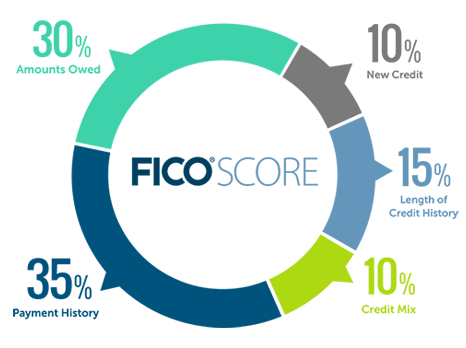

Your payment history makes up 35 of your credit score which makes it the most important. Pay off debt and. It s suggested that you request a credit line increase about once every 6 12 months. Your credit utilization ratio is the amount of debt you have divided by the total amount of credit you ve been extended.

When you want to boost your credit score there are two basic rules you have to follow. The aim is to get the agencies to admit to as much wrongdoing as possible so that it can be used to ease your credit report and bring your score closer to what you want your score to be. Using a different kind of credit can make for a modest boost to your score. You may find it surprising to learn that you don t have just one credit score.

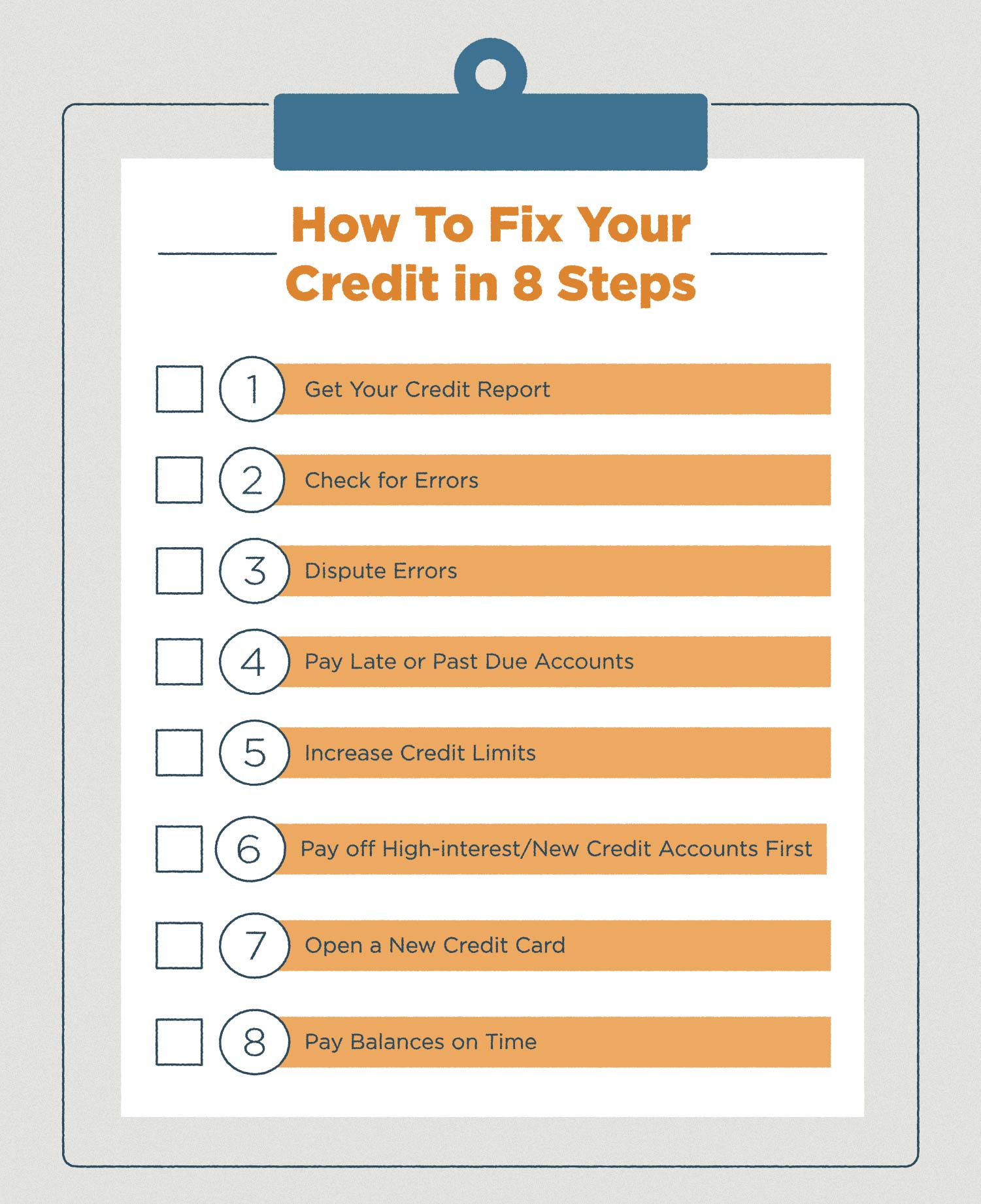

Steps to improve your credit scores 1. Download tally a credit card consolidation app that makes it easy to stay on top of your credit cards. If you ve been making utility and cell phone payments. When lenders review your credit report and request a credit score for you they re very.

Stay on top of payments. 6 ways to improve your credit score 1. Second pay your bills on time and in full. First keep your credit card balances low.

10 tips on how to increase your credit score get a copy of your credit reports. Check your credit reports. For example you might take out a small personal loan from the credit union or buy a piece of furniture or appliance on. It helps with your credit utilization ratio which helps your credit score.

Get your credit score credit report credit monitoring. Get credit for making utility and cell phone payments on time.

/things-that-boost-credit-score-960381-v2-9599c06fcdfd4108b67a291dabd43b7d.gif)